Payroll tax formula

For examples of how to set up formulas and tables open the sample company Bellwether Garden Supply. Withhold a total of 235 for Medicare.

Paycheck Calculator Take Home Pay Calculator

Ad Get Access To Unlimited Payrolls Automatic Tax Payments Filings and Direct Deposit.

. Get Started for Free. Ad Payroll So Easy You Can Set It Up Run It Yourself. About the Payroll Formula Field.

How to calculate payroll tax liabilities. First gather all the documentation you need to reference to calculate withholding tax. State Federal and Territorial Income Taxes.

From the File menu select Payroll Formulas then User. So far 2020 has proved to be a tumultuous year especially for business owners. HR and Payroll Tax Formulas.

Payee for certain formula types. This is the last two digits of the calendar year to which this tax formula applies. From the File menu select Payroll Formulas then.

Calculating Federal Income Tax. All Services Backed by Tax Guarantee. Compare Side-by-Side the Best Payroll Service for Your Business.

This is how much to withhold from Employee. When Congress passed the Coronavirus Aid Relief and. To see examples of how to set up formulas and tables open the sample company Bellwether Garden Supply.

New changes to payroll taxes in 2020 to 2021. Payroll Withholdings Tax Formulas Overview. Add the regular Medicare tax rate 145 to the additional Medicare tax rate 09.

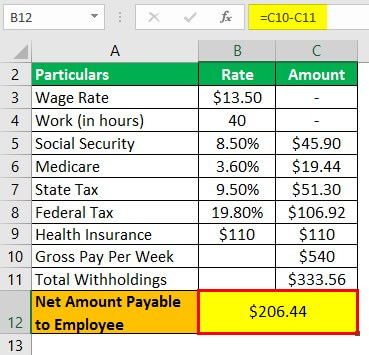

Formulas determine how much to withhold from each paycheck for things like income tax social security medicare health insurance. Check your employees Form W-4 for their marital status gross income and number of allowances. Ad Make Your Payroll Effortless and Focus on What really Matters.

Open the IRS Publication 15-A. The payroll tax liability is comprised of the social security tax Medicare tax and various income tax withholdings. Here are the steps to calculate withholding tax.

The formula for Income Tax therefore becomes as 015 Gross Pay. This guide reflects some income tax changes recently announced which if enacted as proposed would be effective July 1 2022. Import Payroll Runs To Be Automatically Categorized As Expenses.

EE employee pays or ER employer pays payroll tax year. Which in terms of excel payroll sheet can be formulated under cell G2 as 015F2 Column F contains Gross Pay. Listed below are recent bulletins published by the National Finance Center.

At the time of publishing these proposed.

Payroll Calculator With Pay Stubs For Excel

How To Calculate 2019 Federal Income Withhold Manually

Payroll Formula Step By Step Calculation With Examples

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Formula Step By Step Calculation With Examples

How To Create An Income Tax Calculator In Excel Youtube

Payroll Calculator With Pay Stubs For Excel

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes Methods Examples More

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Tax Calculator For Employers Gusto

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax

How To Calculate Federal Withholding Tax Youtube