Salary calculator plus overtime

Overtime pay calculation for nonexempt employees earning a salary A salary is intended to cover straight-time pay for a predetermined number of hours worked during the workweek. 1500 per hour x 40 600 x 52 31200 a year.

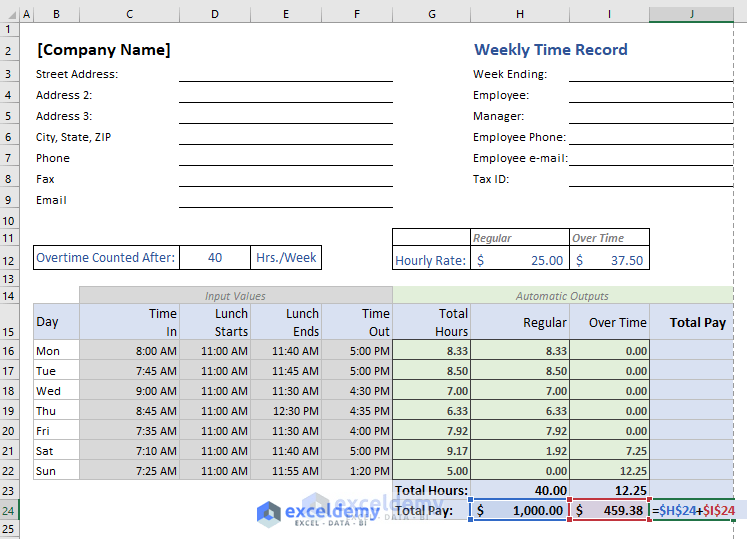

Excel Formula For Overtime Over 40 Hours With Free Template

Overtime pay for salaried employees can seem tricky to calculate but its actually fairly simple.

. Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. In addition a rate of nothing is included for people who. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

TP refers to Total Pay RP refers to Regular Pay which you. Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Free online gross pay salary calculator plus.

Of overtime hours Overtime rate per hour. Pay rates include straight time time and a half double time and triple time. Your employer is required by federal law Fair Labor Standards Act to pay time and a half wages regular hourly rate x 15 for all hours worked beyond 40 hours per week.

Overtime pay of 15 5 hours 15 OT rate 11250 Wage for the day 120 11250 23250 Dont forget that this is the minimum figure as laid down by law. -Total gross pay. You expect that employee to work 36 hours a week.

For the cashier in our example at the hourly wage. Overtime wages for a salary with fixed hours For this example lets assume your employee earns 500 per week. Examples of payment frequencies include biweekly semi.

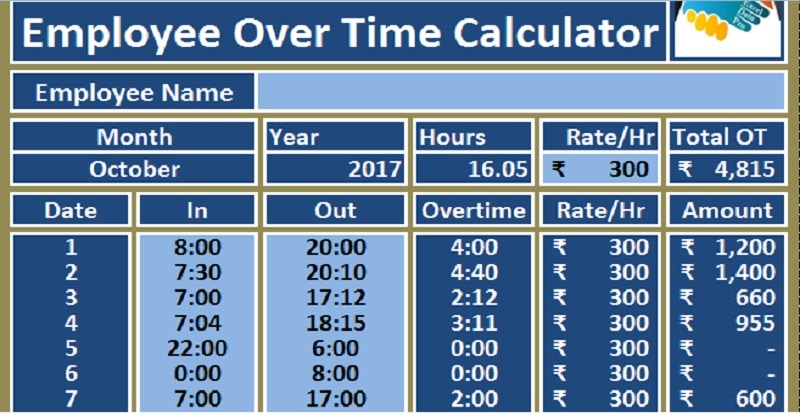

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. The calculator includes rates for regular time and overtime. And in the second section you input your overall weekly hours.

Here are the steps to calculate overtime earnings. Get an accurate picture of the employees gross pay. Due to the nature of hourly wages the amount paid is variable.

One way to do it is to divide their weekly pay by the number of hours they work in. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. Finally you can find the total salary at months end by adding the employees Regular Pay and the Overtime Pay.

So if your regular. You can claim overtime if you are. Summary report for total hours and total pay.

Calculate the gross amount of pay based on hours worked and rate of pay including overtime. TP RP OP where. In the first section you can input your monthly salary and have the calculator break down your weekly salary and hourly rate.

-Overtime gross pay No. Verify that youre non-exempt and qualify for overtime Overtime does not apply to employees with administrative or executive. The algorithm behind this hourly paycheck calculator applies the formulas explained below.

The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements.

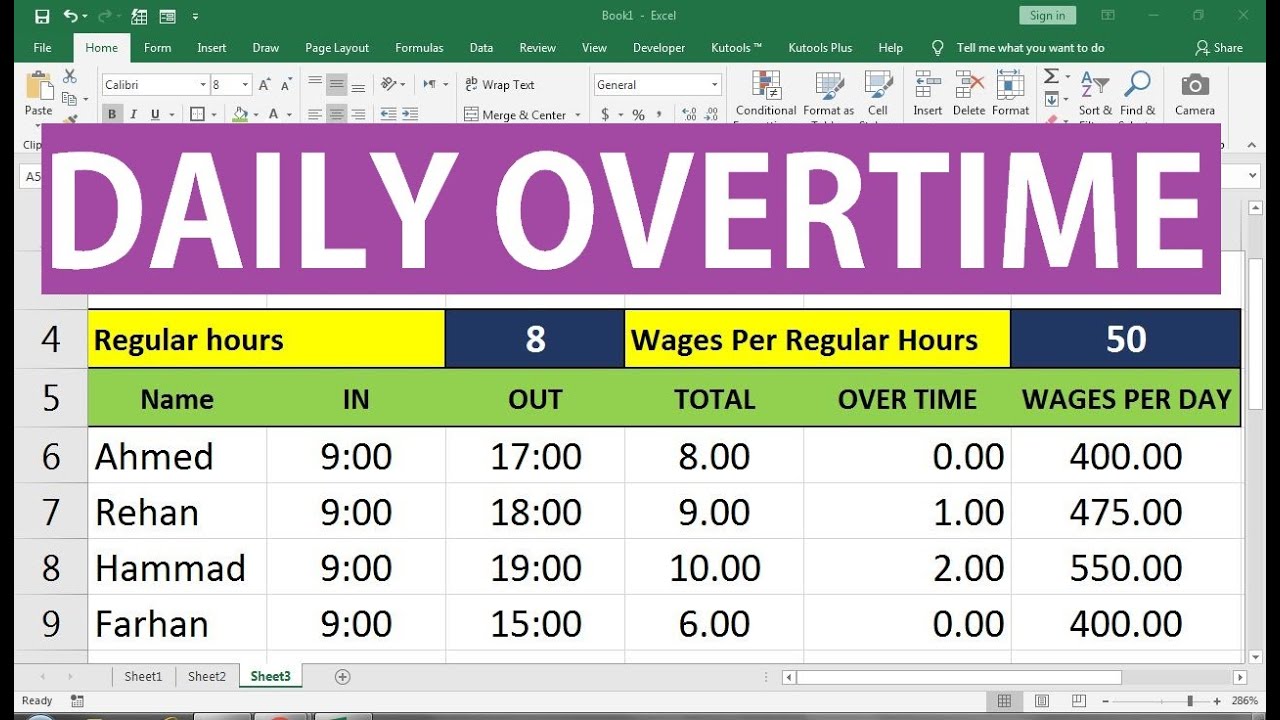

Calculate Overtime In Excel Google Sheets Automate Excel

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

Excel Formula To Calculate Hours Worked Overtime With Template

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Excel Formula Basic Overtime Calculation Formula

Overtime Pay Calculators

Overtime Calculator Workest

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Calculator

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators

Overtime Pay Calculators

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Hourly To Salary What Is My Annual Income

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Calculate Overtime In Excel In Hindi Youtube