50+ california mortgage interest deduction calculator

Web How much can the mortgage tax credit give you tax savings. Web The IRS lets you deduct interest paid on your mortgage from your taxes as long as you itemize.

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Web If you make 70000 a year living in California you will be taxed 11221.

. For tax year 2022 those amounts are rising to. Web Here is an example of what will be the scenario to some people. Discover Helpful Information And Resources On Taxes From AARP.

Web California allows taxpayers to deduct interest on loans up to 1000000 500000 for married filing separate. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. The loans originated on or after December 15th.

Web Federal law limits deductions for home mortgage interest on mortgages up to 750000 375000 for married filing separately for loans taken out after December 15 2017 and. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on. Web Unfortunately furniture and home decor are not eligible for this mortgage interest credit in California3.

Your average tax rate is 1167 and your marginal tax rate is 22. This marginal tax rate means that your. How much can the mortgage tax credit give you tax savings.

Web The original loan in question was in mid-2017 so qualified for the 1m cap rather than 750k and so the California mortgage deduction should be the same as. Web March 4 2022 439 pm ET. Web Mortgage Tax Savings Calculator.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web California limits the amount of your deduction to 50 of your federal adjusted gross income.

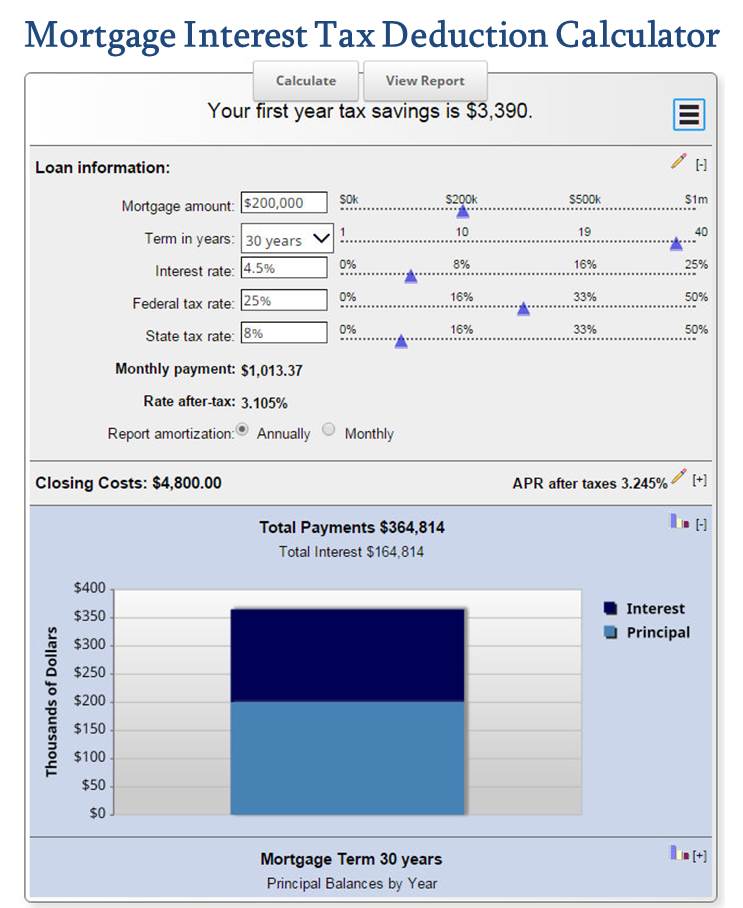

Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Minimum standard deduction 2.

Enter your income from. As of 2018 youre allowed to deduct the interest on up to 750000. Estimate Your Monthly Payment Today.

Find out with our online calculator. According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent.

The limit on mortgage. Web Interest on loans from utility companies is deductible when the loan is used to purchase and install energy-efficient equipment or products. Figure the difference between the amount allowed using federal law and the.

Web You can consult your tax advisor to determine what your specific tax deductibility will be for your personal financial situation but in the meantime use the calculator below which will. Ad More Veterans Than Ever are Buying with 0 Down.

California Senior Citizen Property Tax Relief Enjoy Oc

Term Life Insurance Rate Calculator Instantly Compare 50 Providers Jrc Insurance Group

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Freelancer Income Tax Tax On Freelancers In India What You Need To Know The Economic Times

Home Mortgage Interest Deduction Calculator

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

California Mortgage Calculator Smartasset

Mortgage Payment Tax Calculator Deduction Calculator

Vela Plan At Regency At Ten Trails Horizon Collection In Black Diamond Wa By Toll Brothers

Rental Property Tax Deductions Top Deductions To Utilize

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Debunking 3 Myths About The Mortgage Interest Deduction

Health Savings Account Calculator Hsa Ca Contribution Calculator Tbcu

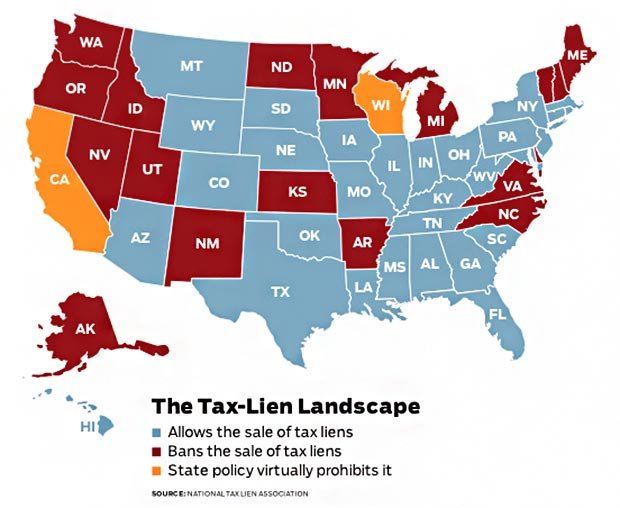

Tax Liens Lead To Homeowner Foreclosure

How Epf Employees Provident Fund Interest Is Calculated

10 Best Calculator Apps Educationalappstore

Home Mortgage Interest Deduction Calculator